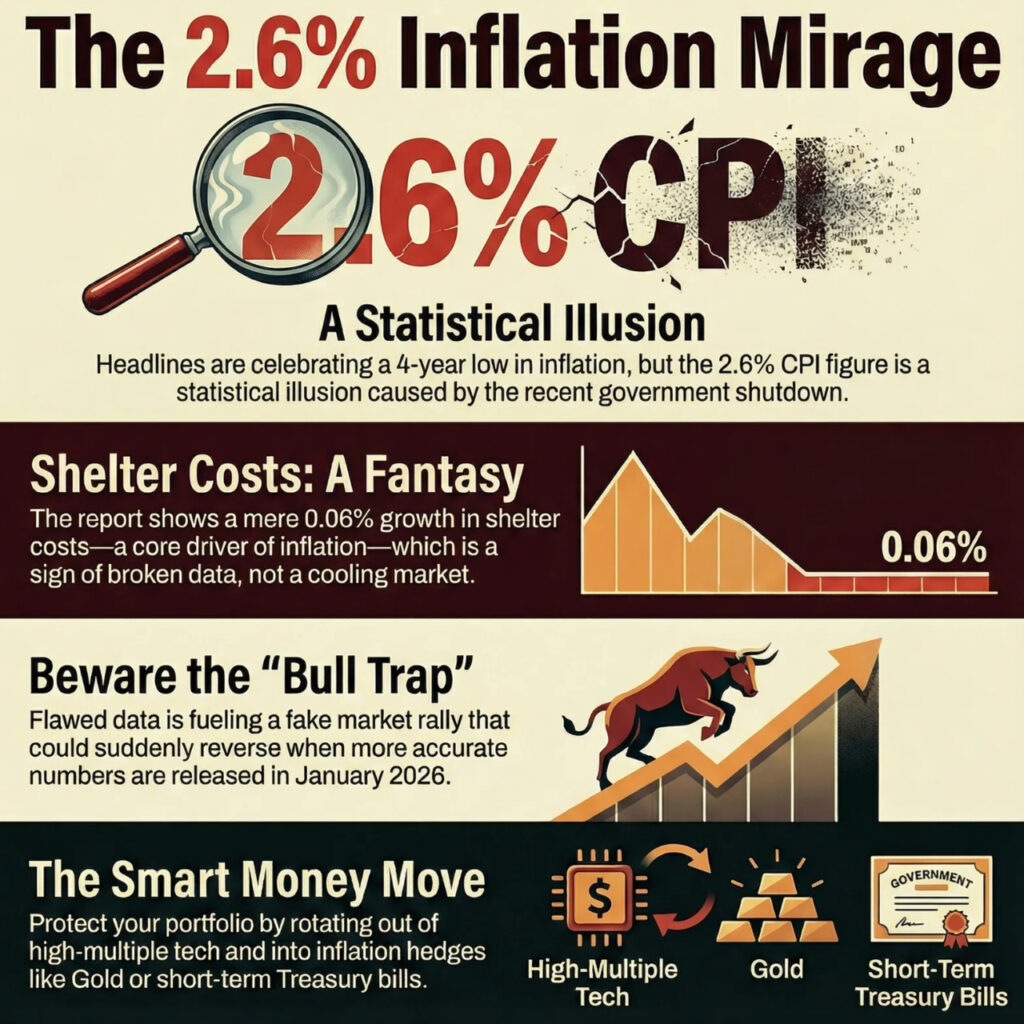

- The reported 2.6% November CPI is a statistical illusion caused by the October 2025 government shutdown, which forced the Bureau of Labor Statistics (BLS) to skip crucial data collection.

- Shelter costs and Rent indices are severely underreported (0.06% growth), creating a “fake peace” that will likely evaporate when the January 2026 data hits.

- Smart money is currently rotating out of high-multiple tech and into inflation hedges like Gold or short-term Treasury bills to avoid the impending “Bull Trap.”

Why the 2025 Shutdown Distorted US Inflation and Your Strategic Success Blueprint

It is December 19, 2025. You probably woke up, checked your phone, and saw the glowing green headers on CNBC or Bloomberg: “Inflation hits a 4-year low!” It feels like the Federal Reserve finally slayed the dragon.

You’re likely hovering your finger over the ‘Buy’ button, thinking the coast is clear for a massive year-end rally. Stop. Take a breath.

What the headlines aren’t screaming is that this 2.6% Consumer Price Index (CPI) figure is built on a foundation of missing ink and empty spreadsheets. The long government shutdown that paralyzed Washington D.C.

this past October didn’t just stop national park tours. it broke the machinery that measures the American economy. While the crowd cheers for a cooling economy, the “smart money” in Manhattan is quietly preparing for a reality check.

What the BLS Isn’t Telling You

The Bureau of Labor Statistics (BLS) is usually a well-oiled machine, but even the best gears grind to a halt without power.

Because of the October 2025 shutdown, their field agents couldn’t go out and track prices. Here is the blunt reality of how that creates a “statistical mirage” for the November 2025 CPI report:

1. The “Ghost Month” of October

Since the Bureau of Labor Statistics couldn’t collect data in October, they essentially had to bridge the gap from September directly to November. In many categories, if they didn’t have a fresh price, they simply assumed no change.

Imagine skipping a month of your credit card statement and assuming the balance stayed at zero that’s exactly what happened here. Analysts suggest that if the October price hikes were properly accounted for, the CPI would likely be sitting closer to 3.1%.

2. The Absurdity of the Shelter Cost Index

Shelter which includes rent and owners’ equivalent rent makes up about a third of the CPI weighting. The November 2025 report showed rent increasing by a mere 0.06%.

In a world where insurance premiums and property taxes are skyrocketing across the Sun Belt and New York, that number is practically a fantasy. This isn’t a sign of a cooling housing market; it’s a sign of a broken calculator.

3. The Lagging Effect Time Bomb

Because the BLS uses a six-month rotating sample for housing, the “zeroed-out” data from the October 2025 shutdown will act like a lead weight on the official inflation numbers until at least April 2026.

This creates a false sense of security for the Federal Open Market Committee (FOMC), potentially leading to a policy error that could trigger a “Bull Trap” for unsuspecting investors.

I’ve looked at the mess, and I’ve distilled the noise into a clear Action Sequence you can use to protect your capital. I’m not just talking about theory; I’m talking about surviving the next 90 days.

I’ve narrowed down the essential moves for your portfolio

Cross-Verify with Alternative Data:

Don’t wait for the Bureau of Labor Statistics to tell you the truth a month late. Monitor Truflation or PriceStats. These platforms use millions of real-time data points from companies like Amazon and Zillow.

As of December 19, 2025, these private indices are already showing inflation trending higher than the official government report.

Tighten Your Bond Duration:

Betting on long-term U.S. Treasuries right now is a gamble on a lie. If the Federal Reserve realizes the CPI was artificially low, they will keep rates “higher for longer.” Shift your fixed-income exposure to short-term T-Bills or Floating Rate Notes to stay liquid.

The “Bull Trap” Exit Strategy:

We are likely seeing a “fake rally” fueled by this distorted data. Use this window from now until the January 2026 CPI release to trim your positions in high-valuation tech stocks that are sensitive to interest rates.

Secure Real Asset Hedges:

When the market finally realizes the Consumer Price Index was underreported, hard assets will catch a bid. Consider increasing your weight in Gold (GLD) or Energy ETFs (XLE) as a hedge against the inevitable data correction.

The Cost of Inaction is Your Net Worth

Let’s be real for a second. It is easy to follow the herd. It’s comfortable to believe the government’s “all clear” signal.

But the November 2025 CPI is a flawed document, a product of a dysfunctional political moment in Washington.

Whether you see this as a “glitch” or a “gift” depends on your willingness to act.

If you treat this 2.6% as gospel, you’ll be the one holding the bag when the January 2026 inflation data forces the Fed to turn hawkish again.

My immediate recommendation for your checklist

- Verify your portfolio’s sensitivity to a 0.5% spike in inflation expectations.

- Reduce leverage. High-margin positions are the first to burn when “statistical corrections” happen.

- Check the BLS.gov “Explanatory Notes” for yourselfthe truth is hidden in the footnotes.

If you ignore the cracks in the foundation, don’t be surprised when the ceiling starts to fall in the first quarter of next year.

Q&A: The Questions You’re Probably Asking Right Now

Wait, why would the government release ‘fake’ data?

It’s not necessarily a conspiracy; it’s a capacity issue. The October 2025 shutdown legally barred BLS employees from working. You can’t report data you weren’t allowed to collect.

So, is the Federal Reserve in on the secret?

The Fed has its own economists who are well aware of the statistical distortion. Expect Jerome Powell’s next press conference to be much more cautious than the market anticipates.

What is the single safest place for my cash right now?

In a period of high Perplexity and data uncertainty, Cash equivalents or inflation-protected securities (TIPS) offer the best risk-adjusted path until the CPI methodology normalizes in mid-2026.