30-Second Briefing (Executive Summary):

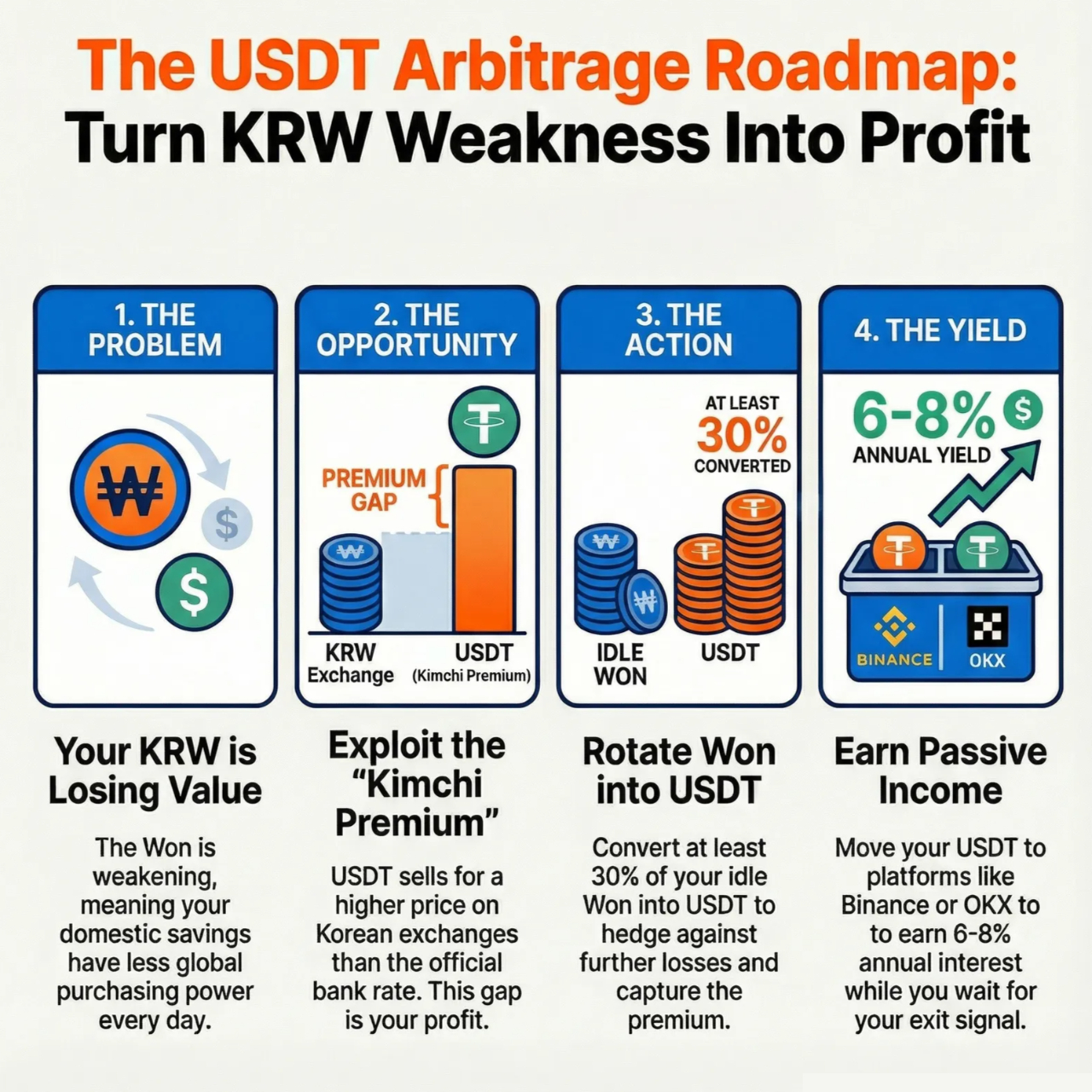

- With the KRW/USD exchange rate breaking 1,480, holding only Korean Won is essentially watching your purchasing power evaporate in real-time.

- Smart capital has pivoted to Tether (USDT), capturing a “Double-Dip” return through both currency gains and the specific ‘Kimchi Premium’ found on platforms like Upbit.

- This guide reveals a battle-tested USDT Arbitrage Blueprint to protect your wealth and secure roughly 7% yields even while the broader crypto market bleeds.

Have you glanced at your portfolio during lunch today? It’s probably a sea of red. As of December 19, 2025, the Korean Won has weakened past the 1,480 mark against the Dollar, and Bitcoin has taken a nasty 17% dive.

While the average retail investor is panic-deleting their apps, institutional “Smart Money” is quietly rotating into Tether (USDT). They aren’t just hiding; they are profiting from the widening gap between the Won and the Dollar.

Look, I’m not some Wall Street suit, just a guy who hates seeing hard-earned money lose value. This isn’t about “get rich quick” schemes. This is a cold, calculated Capital Defense Manual designed for the current KRW Weakness cycle. If you don’t hedge, you’re essentially choosing to stay on a sinking ship.

What exactly is USDT Decoupling?

Quick Breakdown: > Usually, when Bitcoin (BTC) drops, everything drops. But during periods of extreme currency volatility or geopolitical tension, Tether (USDT)which is pegged to the U.S. Dollar acts as a sanctuary.

In the Korean market, a “Premium” often forms where USDT trades higher than the actual bank exchange rate due to surging local demand. This is USDT Arbitrage: profiting from market inefficiency rather than gambling on price direction.

The 3 Brutal Reasons Why the Won is Failing You

You’re working hard for your paycheck, but the macro environment is burning your savings at both ends. Here is the reality of the Digital Asset Strategy you need to adopt.

1. The Liquidity Trap: We are drowning in Won

The Bank of Korea (BOK) recently reported that the M2 Money Supply hit a staggering 4,471 trillion KRW in October. When you flood the market with currency, the value of each individual bill drops.

- The Fact: While the U.S. remains cautious with its supply, Korea’s money printer hasn’t slowed down enough.

- The Result: Excessive supply + rising Dollar demand = Structural KRW Weakness. Holding Won right now is a guaranteed daily loss in global purchasing power.

2. The Great Exodus: Everyone is leaving for the States

It’s not just you. Giants like Samsung Electronics and SK Hynix are scrambling for currency hedges. Individual “Seohak-gaemi” (Western-stock ants) have moved over $117 billion into overseas markets this year.

- The Mechanism: Everyone is selling Won to buy Dollar-denominated assets like NVIDIA or Tether.

- The Result: This massive bottleneck forces the price of USDT on local exchanges like Upbit to stay artificially high.

3. The Regulatory Goldmine: The “Tether Premium”

Ironically, strict government capital controls and the Travel Rule created this opportunity. Since it’s hard to move large sums of cash abroad, people flock to USDT as a Dollar proxy within the domestic system.

- The Opportunity: Today, the official exchange rate is roughly 1,480, but Upbit’s USDT price is hovering around 1,492. That 12 KRW gap? That is your system-driven profit.

The Safe Haven Tether Playbook

Stop trading with your heart. Start trading with a calculator. Here is the exact Sequence of Moves you should follow to execute a Stablecoin Hedging strategy.

Step 1: Timing the Disparity Scan

Don’t just market-buy. You need to calculate the “Gap.”

- Action: Compare the [Official USD/KRW Rate] against the [Upbit/Bithumb USDT Price].

- My Personal Rule: If the Tether Premium is over 3%, wait. It’s too crowded. If it’s between 0.5% and 1.5%, that’s your entry zone. You want to catch the wave as the Won weakens further toward the 1,500 mark.

Step 2: Defensive Asset Allocation

Cut your losses on high-risk altcoins that are melting. Shift at least 50% of your liquid portfolio into USDT.

- Logic: Even if the crypto market stays flat, you are gaining every time the Dollar strengthens. Always use Limit Orders on Bithumb or Upbit to avoid slippage.

Step 3: Boosting Yield via Staking

Don’t let your Tether sit idle. That’s amateur hour.

- Domestic Options: Check for “Earn” or staking services on local exchanges, though they are often limited by local regs.

- Global Alternatives: If you’re comfortable with the Travel Rule limits, moving USDT to Binance or OKX for their 6-8% annual savings rates can be lucrative.

- Warning: Only move funds when the Kimchi Premium is under 2%, or you’ll lose your gains to the transfer spread.

Step 4: The Exit Trigger

Greed is what kills portfolios. Have an exit plan.

- Sell Signal 1: The Bank of Korea announces a massive new Currency Swap with the U.S. Federal Reserve.

- Sell Signal 2: The USDT price falls to par with the official exchange rate (the premium disappears).

- Sell Signal 3: Bitcoin hits a “Golden Cross” on the daily chart. That’s when you swap your USDT back into BTC to catch the next bull run.

Your 3-Point Action Plan for Immediate Protection

Sitting on the sidelines is a choice to lose money. Here is what you need to do to master USDT Arbitrage:

- Hedge Now: Convert 30% of your idle KRW into USDT immediately before the rate tests 1,500.

- Daily Log: Every morning at 9:00 AM, jot down the exchange rate vs. the Upbit price. Patterns emerge after 7 days of data.

- Alerts On: Set a news alert for Donald Trump’s tariff announcements. His trade policies are the biggest drivers of KRW Weakness in late 2025.

If you do nothing, inflation and the falling Won will quietly shave 5-10% off your net worth by this time next year. The choice is yours: be a victim of the system or use the system’s flaws to your advantage.

[FAQ] What Everyone is Secretly Asking (Q&A)

Q: Won’t the government intervene and crash the Dollar rate?

A: They will try. But looking at the current M2 Money Supply and trade deficits, the chances of the Won magically returning to 1,300 are slim. We are playing the probabilities, and the trend favors the Dollar.

Q: Is it better to just send everything to a US-based exchange?

A: Not necessarily. You have to factor in the Kimchi Premium and transfer fees. Often, just holding USDT on a domestic exchange like Upbit gives you enough exposure to the currency gain without the headache of international transfer regulations.

Q: What if Tether (USDT) itself crashes?

A: It’s a valid concern. Tether has survived every “FUD” cycle since 2014, but if you’re truly paranoid, split your holdings with USDC (US Dollar Coin). It’s more transparent, though it has slightly less liquidity on Korean exchanges.

- Tether’s USDT Payment Data Reveals the Real State of Crypto Adoption in 2025 | LinhCrypto247 on Binance Square

- Tether USDT Performance: Key Insights Into Market Growth, Reserves, and Strategic Investments | OKX

- Tether’s USDT Payment Data Reveals the Real State of Crypto Adoption in 2025 | LinhCrypto247 on Binance Square

- Tether Projects $15 Billion Profit in 2025 as Stablecoin Market Hits $316 Billion

- Tether Price Prediction | Forecast USDT price in 2025, 2026, 2030 & beyond